Are Stated Income Loans Back?

Remember back in the early and mid-2000’s when no documentation home loans became very popular?

If not, perhaps you were still a bit young, you weren’t a self-employed home buyer, or you had not yet become involved in the real estate industry. In any event, if you’re not familiar with what a no doc mortgage is, and you are a buy and rent investor, I’m sure this article will be of great interest to you!

If not, perhaps you were still a bit young, you weren’t a self-employed home buyer, or you had not yet become involved in the real estate industry. In any event, if you’re not familiar with what a no doc mortgage is, and you are a buy and rent investor, I’m sure this article will be of great interest to you!

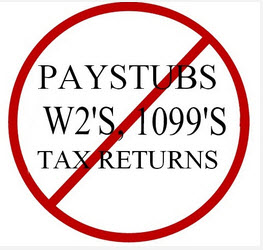

In a nutshell, a no doc, or “stated income” home loan simply meant that there was no employment, income or asset verification required in order for you to get a mortgage. The borrower would qualify for a home loan based almost entirely on his or her credit history. And a lender would use that criteria to decide whether to approve or reject a mortgage.

As you’ve probably already guessed, many of the failed mortgages from this era were no documentation home loans offered by subprime lenders. And in many cases, these loans were taken out by individuals who were a little less than honest when it came to stating their income.

But for those who used these programs responsibly in the past, without a doubt, no doc mortgages absolutely streamlined the home buying and/ or refinancing process!

And it appears that many banks, credit unions and mortgage lenders have begun to re-introduce limited and reduced income documentation mortgages. These products allow you qualify with no personal income verification or requirements.

Qualification is based on your credit score, the value of the property, as well as rental income from the financed property. And in some cases, “cash out” is allowable to help you to make any necessary repairs!

In short, if your credit is great, and you’re looking to buy a rental property, but you haven’t been able to qualify for a conventional mortgage, the good news is that there are now viable options available to you.

The typical maximum LTV is 75% to 80%, and title can be taken as LLC, corporation, or individual. In addition, no doc loans are typically easier to process, and in many cases, escrow can close faster than with traditional mortgages.

![]() Obviously, finding an investment property with existing equity and accurate rental data would be the smartest way to proceed. And our exclusive smart map comping system is a great place to start conducting your research.

Obviously, finding an investment property with existing equity and accurate rental data would be the smartest way to proceed. And our exclusive smart map comping system is a great place to start conducting your research.

Smart Map Systems helps you to locate properties with equity, or research your own. Then calculates ARVs (After Repair Value) and ROI (Return on Investments) for Buy & Hold, Fix & Flips, Additions, as well as new construction projects.

We work with mortgage brokers who specialize in financing programs for investors. For more information about our financing partners and options, click here.

In closing, I’d like to thank you for taking the time to read this article. If you have any questions, or you need help analyzing a particular property, please don’t hesitate to contact me.

In closing, I’d like to thank you for taking the time to read this article. If you have any questions, or you need help analyzing a particular property, please don’t hesitate to contact me.

Laura Leatherdale

P.S. For more information about our Smart Map Systems technology and how it can help you to locate and research profitable real estate deals, Click Here To Watch Video!